[ad_1]

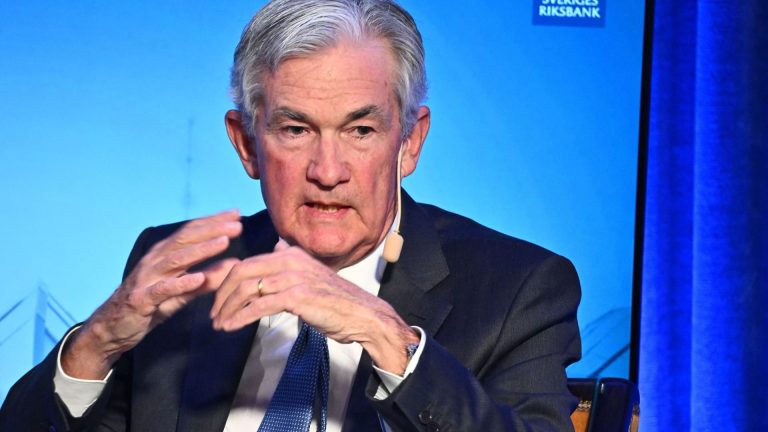

Chair of the Board of Governors of the Federal Reserve System Jerome H. Powell participates in a panel during a Central Bank Symposium at the Grand Hotel in Stockholm, Sweden, January 10, 2023.

Claudio Bresciani | TT | via Reuters

Here are the most important news items that investors need to start their trading day:

1. Welcome to Fed-ruary

The Federal Reserve is set to announce its latest rate hike on Wednesday afternoon. Markets are expecting a quarter-point increase, which is lower than the past few. Yet, as CNBC’s Patti Domm writes, market pros anticipate Fed Chairman Jerome Powell will continue using a hawkish tone as he describes the Fed’s path forward in its fight against inflation. The expected hike Wednesday would put its rate range at 4.50% to 4.75%, which is close to the Fed’s estimated end point of 5% to 5.25%. The announcement is scheduled for 2 p.m. ET, and Powell will speak at 2:30.

2. New month will test stock rally

Traders on the floor of the NYSE

Source: NYSE

Last month will be a tough act to follow. The S&P 500 posted its best January since 2019, while the Nasdaq recorded its best January in 22 years. All three major indices finished higher Tuesday, putting an exclamation point on the month as bulls look to build momentum after last year’s declines. And while investors will be chewing over what the Fed has to say Wednesday, they’ll have lots more on their minds as earnings season presses forward. Facebook parent Meta reports after the bell Wednesday, and Thursday will be an earnings bonanza, with Apple, Amazon, Starbucks and others due to report. Read live markets updates.

3. Google under AI pressure

Google headquarters in Mountain View, California, US, on Monday, Jan. 30, 2023. Alphabet Inc. is expected to release earnings figures on February 2.

Marlena Sloss | Bloomberg | Getty Images

It’s “code red” at Google as the search giant races to compete with the buzzy artificially intelligent chatbot ChatGPT. Google’s “Atlas” project is testing a chatbot called “Apprentice Bard,” which is intended to give complex answers to questions much the way ChatGPT does. Employees are also testing whether it could be integrated into a search engine. The news, reported by CNBC’s Jennifer Elias, comes after employees pressured executives in December over how parent company Alphabet was going to respond to ChatGPT’s sudden burst of popularity. At the time, CEO Sundar Pichai and Google AI chief Jeff Dean hinted that the company could release similar products during 2023.

4. Can’t Snap out of it

Co-founder and CEO of Snap Inc. Evan Spiegel attends the Viva Technology conference dedicated to innovation and startups, at the Porte de Versailles exhibition center in Paris, France June 17, 2022.

Benoit Tessier | Reuters

Snap is stuck in a rut. The social media company posted its third straight disappointing quarterly earnings report Tuesday, sending the stock down double digits during off-hours trading. Things don’t look like they’ll pick up soon, either, after companies cut their digital ad budgets. In a letter to investors, Snap said it expects revenue to decline in the current quarter by between 2% and 10% compared with the year-ago period. Analysts had expected a small uptick in revenue. “On the monetization side, we anticipate that the operating environment will remain challenging, as we expect the headwinds we have faced over the past year to persist throughout Q1,” the company said.

5. Dangerous radioactive capsule found

The Great Northern Highway. Western Australia. A radioactive device belonging to mining firm Rio Tinto was found on the roadside after coming off the back of a truck.

Reda&co | Universal Images Group | Getty Images

We’ve been hearing a lot about the tiny – we’re talking 6 mm by 8 mm here – radioactive capsule that fell off a truck deep in a remote part of Australia. Thankfully, authorities said it was found after an extensive, nearly weeklong search about 1,100 kilometers north of Perth. The object, which is part of a measurement gauge, could have caused severe radiation burns and sickness for anyone who came in contact with it. Indeed, authorities told people to stay about three yards away from the device if they spotted it. (Then again, how could you spot such a tiny thing from that distance?) Mining company Rio Tinto apologized earlier this week for the mishap.

– CNBC’s Patti Domm, Carmen Reinicke, Jennifer Elias, Jonathan Vanian and Jenni Reid contributed to this report.

— Follow broader market action like a pro on CNBC Pro.

[ad_2]

Source link