[ad_1]

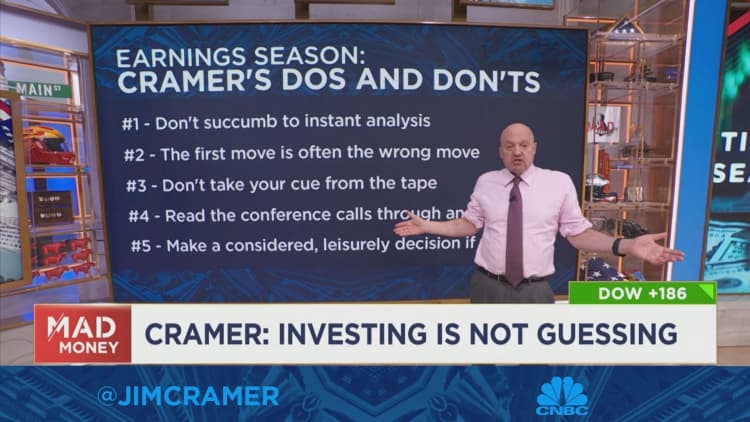

CNBC’s Jim Cramer on Tuesday went over a list of do’s and don’ts for investors ahead of a busy period of earnings.

The upcoming earnings season, which kicks off this week, features quarterly updates from the nation’s largest banks, manufacturers and airlines.

Here are the five rules for investors to remember, according to Cramer:

- Don’t succumb to instant analysis. Investing isn’t a time-sensitive act.

- The first move is often the wrong move. That means investors shouldn’t make investing judgments solely based on how many companies perform compared to analysts’ consensus estimates.

- Don’t take your cue from the tape. In other words, investors shouldn’t buy a stock unless they’ve done the homework themselves to research the company.

- Read the conference calls, thoroughly. The question and answer portion is especially important since it shows if analysts are truly happy with the quarter.

- Make a considered decision if you buy. Weigh whether Wall Street misinterpreted the quarter – which could result in a buying opportunity.

Cramer added that a chief executive’s willingness to buy back stock after the company reports earnings is yet another sign that investors should buy the stock themselves.

Above all, investors must be cautious and measured, he said. “This is a tortoise and the hare situation, so take it slow.”

[ad_2]

Source link